Return on Investment (ROI) is one of the simplest and most powerful metrics for understanding business performance. It tells you how effectively your organisation converts resources into results. Whether you’re investing in a new platform, training, or process, ROI reveals whether the effort delivers measurable value.

In inventory management, ROI isn’t just about percentages. It’s about whether your data, stock, and systems work together to support growth. As we explain in Why ROI in inventory management is different, the true return often lies in improved visibility, fewer manual tasks, and faster decision-making, benefits that strengthen the whole supply chain, not just the balance sheet.

What does return on investment mean?

ROI stands for Return on Investment, a measure of how much profit or value an investment generates compared to its cost.

- Return refers to the benefit gained, such as higher revenue, reduced costs, or efficiency improvements.

- Investment covers the total input, including money, time, and effort, required to achieve that gain.

A high ROI signals a strong and efficient investment, while a low ROI may indicate missed opportunities or inefficiencies.

As Investopedia explains, ROI is a versatile and universal performance measure that helps compare multiple initiatives, from software projects to production upgrades.

What insights can ROI provide?

ROI gives leaders a clear way to assess whether an initiative is worth it and where to focus resources next. It can highlight:

- Profitability – whether the investment generates tangible financial gains.

Example: A company upgrades to automated demand forecasting software and sees a 15% reduction in overstock. The improved accuracy leads to higher margins, confirming that the project is financially sound. - Efficiency – how well time, labour, and capital are being used.

Example: A distributor uses our platform to automate replenishment. Planners save several hours each week, freeing time for strategic analysis instead of manual ordering. The same team now delivers more output with fewer resources. - Comparability – how different projects perform relative to each other.

Example: One warehouse invests in new storage equipment, while another implements data-driven inventory control. Comparing ROI across both projects helps the business decide which investment model yields better long-term efficiency. - Sensitivity – how changes in variables affect the overall return.

Example: A wholesaler models ROI under different demand scenarios. By testing best- and worst-case conditions, the team learns that improving supplier reliability increases ROI by 10%, showing where to focus improvement efforts.

In inventory management, ROI extends beyond immediate savings. As we discuss in our analysis of inventory ROI, the benefits often include better service levels, reduced working capital, and more accurate forecasting, improvements that continue to deliver value long after implementation.

How to calculate return on investment

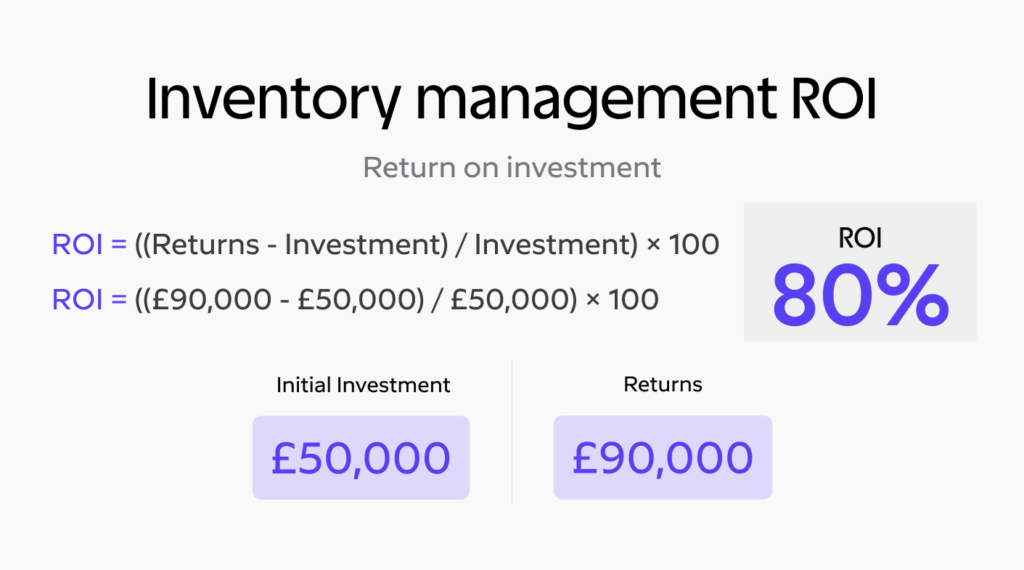

The standard ROI formula is:

ROI = (Net Profit / Cost of Investment) × 100

This gives a percentage that indicates how much return was generated for every pound spent.

Example: calculating ROI for inventory management

Suppose your business invests £50,000 in an inventory optimisation solution. Within one year, it delivers £90,000 in combined savings and additional sales.

ROI = ((£90,000 – £50,000) / £50,000) × 100 = 80%

That means the investment produced an 80% return, a strong indicator of value creation.

Real-world ROI example: Newitts

Sports retailer Newitts implemented our demand forecasting and replenishment system to improve visibility and automate stock decisions. By replacing manual spreadsheets with automated data insights, Newitts:

- Reduced manual ordering workload.

- Improved stock availability across thousands of SKUs.

- Released cash previously tied up in excess inventory.

These improvements not only streamlined operations but also produced a measurable return by freeing capital, improving service levels, and accelerating turnover, all key ROI drivers for a growing retail business.

As Corporate Finance Institute (CFI) notes, comparing different investments with ROI helps identify where each pound delivers the highest impact, and our data-driven approach makes that process precise and actionable.

Beyond the basic formula

While ROI is simple to calculate, it can be adjusted to reflect real-world complexity. Both Investopedia and Corporate Finance Institute (CFI) recommend several variations that make ROI more accurate and meaningful over time:

- Annualised ROI – This version adjusts ROI results to a yearly rate, allowing for fair comparison between projects of different durations. For example, if one investment produces a 20% return in six months and another delivers 25% over two years, annualising the figures reveals which one truly performs better per year. In inventory optimisation, annualised ROI helps evaluate how quickly efficiency improvements, such as reduced holding costs, start to pay off.

- Real ROI – This calculation accounts for inflation and the cost of capital, giving a more realistic picture of profitability. For instance, a 10% ROI might look positive at first, but if inflation is running at 6% and borrowing costs are 3%, the actual gain is minimal. For inventory managers, real ROI ensures that efficiency gains outpace economic pressures and financing costs.

- Expected ROI – This is used before an investment is made to forecast potential returns under different scenarios. It relies on projected savings, revenue gains, or efficiency improvements. Businesses use expected ROI to decide whether a system upgrade or supply chain project is likely to deliver sufficient value. For example, before adopting new forecasting software, you could model its impact on overstock, working capital, and revenue to estimate the likely ROI.

- Social ROI – This variation measures the non-financial benefits that contribute to business value, such as sustainability, waste reduction, or employee wellbeing. For example, an automated replenishment process might cut energy consumption in warehouses, reducing environmental impact while improving staff productivity. Although these gains may not appear in financial statements, they enhance brand reputation and long-term resilience.

These variations make ROI a flexible and powerful tool for decision-making. In inventory and supply chain management, they help quantify both the financial and strategic impact of improvement initiatives, ensuring that every project aligns with broader business goals.

What counts as a good ROI?

There is no single figure that defines a “good” ROI. It depends on your industry, risk level, and business objectives. However, several principles can guide your expectations:

- Retail and wholesale businesses often aim for ROI between 10–20%. These sectors rely on consistent turnover and strong cash flow rather than extreme margins.

- Technology and SaaS companies typically target higher ROI, as solutions can scale quickly with relatively low incremental cost.

- Manufacturing and logistics firms may see lower ROI percentages due to large upfront investments, but long-term consistency and efficiency gains justify the spend.

A good ROI is one that supports your strategic goals and sustains profitability over time. For example, a project that reduces stockouts, improves forecast accuracy, and strengthens customer satisfaction may deliver an ROI of 15%, but its true value lies in operational stability and freed working capital.

In our LinkedIn article on ROI, we highlight another key idea: ROI in inventory management should be viewed as both a financial and operational measure. A modern system may not yield immediate short-term profits, yet it generates lasting returns by improving visibility, forecasting, and collaboration. These elements build a stronger, more adaptable supply chain and compound value year after year.

When evaluating ROI, consider both the quantitative outcome (profit versus cost) and the qualitative improvements that drive future performance. A consistent, steady ROI that aligns with your business strategy is almost always more valuable than a short-lived spike in returns.

How frequently should ROI be calculated?

ROI should be reviewed regularly, ideally quarterly or annually, to ensure investments continue performing.

In inventory management, frequent ROI checks reveal trends that might not show in financial statements, such as growing carrying costs or supplier delays. Ongoing measurement helps teams act early, keeping ROI strong over time.

Limitations of ROI

Both Investopedia and CFI emphasise that ROI, while useful, has limitations:

- It does not factor in time or the cost of delayed returns.

- It may overlook qualitative benefits, such as data accuracy or customer satisfaction.

- It can be skewed by accounting differences between departments or projects.

We recommend combining ROI with operational metrics such as stock turnover, order accuracy, and service levels to build a more comprehensive view of business impact.

Other ROI formulas and related metrics

ROI is often used alongside complementary ratios:

- ROMI (Return on Marketing Investment): Measures marketing performance.

- ROAS (Return on Advertising Spend): Tracks advertising efficiency.

- ROE (Return on Equity): Evaluates profit from shareholders’ capital.

- ROA (Return on Assets): Assesses how efficiently assets produce income.

Together, these metrics give leaders a more balanced and nuanced view of performance across the business.

Improving ROI through smarter inventory management

Improving ROI in inventory management starts with better visibility and automation. We help businesses:

- Optimise stock levels to reduce waste and prevent stockouts.

- Automate replenishment for consistent service and fewer manual errors.

- Forecast demand accurately to align purchasing with real sales patterns.

- Turn supply chain data into strategic, ROI-driven decisions.

These improvements do more than increase profit margins. They build resilience and free up working capital that can be reinvested elsewhere.

FAQs about return on investment

What is a good ROI?

It varies by industry, but a good ROI is one that exceeds your business objectives and strengthens long-term value creation.

How is ROI calculated?

Use the formula: (Net Profit / Cost of Investment) × 100. Adjust for time or inflation where appropriate.

How can you improve ROI?

Enhance efficiency, accuracy, and collaboration. Our forecasting and optimisation tools turn inventory data into measurable, sustainable returns.