Understanding your inventory turnover ratio is one of the most effective ways to assess how efficiently your business is managing its stock. If you’re holding onto inventory too long, you’re tying up working capital and risking obsolescence. If you’re turning it over too quickly, you could be understocked and missing sales opportunities. This guide breaks down what inventory turnover ratio is, how to calculate it, and what the numbers really tell you.

What is the inventory turnover ratio?

The inventory turnover ratio measures how often your business sells and replaces inventory within a specific period. It’s a key performance indicator (KPI) that shows how effectively you’re managing your stock and converting it into revenue.

In simple terms, it tells you: how many times did I sell through my inventory during the year?

A higher turnover usually indicates healthy sales and efficient inventory practices. A lower turnover may suggest overstocking, weak demand, or inefficient buying.

The concept originates from cost accounting and is essential for both financial analysis and operational decision-making. Investors and creditors often use this metric to evaluate the liquidity of a company’s inventory.

How to calculate inventory turnover ratio

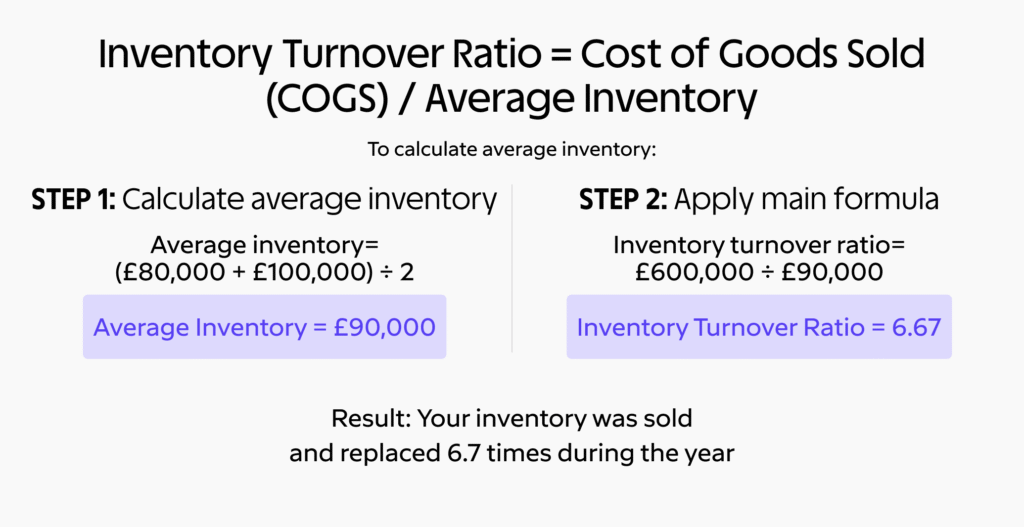

To get a meaningful inventory turnover ratio, you need a reliable method of calculation. This section breaks down the core formula and provides a practical example so you can apply it directly to your own business data.

The basic formula is:

Inventory Turnover Ratio = Cost of Goods Sold (COGS) / Average Inventory

To calculate average inventory:

Average Inventory = (Beginning Inventory + Ending Inventory)

This formula provides a simple but powerful snapshot of how well inventory is being managed.

Example of inventory turnover ratio calculation

Let’s say your cost of goods sold over the year is £600,000. Your beginning inventory was £80,000 and your ending inventory was £100,000.

Average inventory = (£80,000 + £100,000) / 2 = £90,000

Inventory turnover ratio = £600,000 / £90,000 = 6.67

That means your inventory was sold and replaced roughly 6.7 times in the year. According to CFI and Investopedia, a healthy turnover rate generally ranges between 5 and 10 for most industries, though benchmarks vary widely depending on sector and product type.

Understanding the result

Once you’ve calculated your inventory turnover ratio, the next step is interpreting what the number means for your business. The ratio alone doesn’t give the full picture. It must be analysed in the context of your industry, product mix, and operational model.

Low inventory turnover ratio

This could indicate overstocking, slow-moving products, poor sales, or inaccurate forecasting. It ties up capital and increases the risk of obsolescence or spoilage. In industries like fashion or electronics, a low turnover might also reflect outdated inventory that’s losing value over time.

High inventory turnover ratio

Often a sign of efficient inventory management and strong sales. But if it’s too high, it could suggest understocking, frequent stockouts, and missed revenue. Businesses operating with a just-in-time (JIT) inventory model often have high turnover ratios but must balance carefully to avoid disruptions.

How the inventory turnover ratio works in context

There’s no one-size-fits-all number. What’s healthy for a fast-fashion retailer might be unrealistic for an industrial supplier. Use industry benchmarks and historical data from your own business to assess your performance.

AGR’s blog on achieving healthy inventory turnover explores this further, with practical tips and industry-specific context.

Is there such a thing as an ‘ideal’ ratio?

Different industries have different turnover expectations. A grocery wholesaler might aim for a monthly turnover, while a furniture manufacturer may turn inventory just a few times per year. Context matters.

Here’s a quick look at industry benchmarks for inventory turnover ratio:

| Industry | Average Inventory Turnover Ratio | Notes |

| Grocery Retail | 14 – 20 | Fast-moving perishable goods with high stock rotation |

| Apparel | 4 – 8 | Highly seasonal; affected by trends and markdown cycles |

| Electronics | 6 – 10 | Risk of obsolescence makes efficient turnover critical |

| Automotive (Parts Distribution) | 5 – 8 | Mix of fast- and slow-moving SKUs |

| Industrial Equipment | 2 – 4 | High-cost, slow-moving inventory |

| Furniture and Home Goods | 3 – 6 | Long production and delivery cycles |

| Pharmaceuticals | 8 – 12 | Requires tight stock control due to expiry concerns |

| E-commerce (General Merchandise) | 5 – 10 | Strong variability depending on category and platform |

Pair this metric with other KPIs like stock cover, fill rate, and service level to get a more complete view. AGR’s guide to inventory KPIs outlines the key metrics to track alongside turnover.

NetSuite also highlights how turnover ratio can signal how well your business aligns its purchasing decisions with demand patterns. Businesses that review this metric regularly can make smarter decisions about when to reorder, which products to promote, and where to cut back. how turnover ratio can signal how well your business aligns its purchasing decisions with demand patterns. Businesses that review this metric regularly can make smarter decisions about when to reorder, which products to promote, and where to cut back.

What can you use it for?

Inventory turnover isn’t just a number—it’s a decision-making tool. The insights it provides can be applied across operations, finance, and planning to drive performance improvements.

| Purpose | Description |

| Identify overstocked or underperforming items | Spot slow-moving SKUs and take corrective action |

| Improve demand planning and forecasting | Use historical turnover to refine planning models |

| Inform replenishment strategies | Set reorder points and quantities based on turnover rates |

| Free up working capital | Reduce excess inventory to release cash for other areas |

| Communicate supply chain efficiency to stakeholders | Share clear performance indicators internally and externally |

| Help investors assess operational efficiency | Demonstrate strong inventory management as part of financial health |

What can you NOT use it for?

While inventory turnover provides valuable insight, it’s not a catch-all metric. Here are some of the areas where it falls short or can be misinterpreted without additional context.

| Limitation | Reason |

| Measure profitability | High turnover doesn’t guarantee high margins |

| Indicate stock availability or service level | Turnover doesn’t reflect if you had stockouts or delays |

| Capture demand variability or seasonality | Doesn’t account for fluctuating customer behaviour |

| Reveal fulfilment or supply issues | A good ratio may still mask delivery problems |

Use it as part of a broader performance analysis, not in isolation.

Inventory turnover and dead stock

Inventory that doesn’t move becomes dead stock—products that drain capital and warehouse space without generating revenue. A declining turnover ratio is often an early warning sign of this issue.

Dead stock is more than a storage problem. It’s a sign that your forecasting, purchasing, or product lifecycle management has broken down. If left unaddressed, it can lead to write-offs, margin erosion, and missed opportunities to invest in faster-moving products. According to AGR’s guide on what deadstock is and how to manage it, deadstock also contributes to broader supply chain inefficiencies and sustainability issues.

Improving your inventory turnover helps you reduce the risk of deadstock by tightening the link between supply and demand. It also supports better SKU rationalisation, cycle counting, and sell-through rates. Recognising the early signs of deadstock—such as a sudden dip in turnover for specific SKUs—allows businesses to act before problems grow.

Read our full article on deadstock meaning and prevention to see how these two concepts are connected.

Inventory management system

Manual tracking of turnover ratio across SKUs is time-consuming and error prone. A modern inventory management system like AGR’s automates turnover calculations, flags anomalies, and links directly to your forecasting engine.

Our latest Power BI integration lets you visualise turnover trends, spot SKU-level issues, and share insights across your team effortlessly.

But an ERP alone often isn’t enough to close the gap between data and decision-making. Many ERP systems lack the forecasting sophistication and replenishment automation required to stay competitive. AGR fills these supply chain gaps by integrating with your ERP and providing actionable insights designed specifically for inventory planners. From AI-powered forecasting to dynamic safety stock adjustments, AGR delivers the agility most ERP systems lack.

To explore how AGR complements your ERP and improves turnover outcomes, read our blog: Is your ERP enough for inventory management? Here’s how AGR closes the supply chain gaps.

NetSuite recommends tying turnover data to automation tools for better restocking decisions and highlights how inventory dashboards can make the ratio more actionable.

Managing inventory with AGR

AGR’s demand planning and inventory optimisation tools make it easier to:

- Set ideal stock levels

- Automate replenishment

- Forecast with precision

- Avoid both stockouts and excess

With built-in turnover tracking and benchmarking, you’ll always know how your inventory is performing. While AGR integrates seamlessly with Power BI for intuitive visualisation—including a pre-built dashboard for real-time turnover tracking—it also offers an open API. This allows your team to access inventory data directly and build custom dashboards, reports, or tracking systems in the tools you already use. Whether you rely on Power BI or prefer a fully tailored analytics setup, AGR makes it easy to monitor inventory turnover from any angle.

AGR combines intelligent algorithms with real-time visibility, making your planning process more proactive and less reactive. Whether you’re managing a large SKU base or trying to stabilise supply chain volatility, AGR helps you balance inventory levels without compromising service.

Explore our full inventory management product suite to see how AGR can streamline your operations and boost turnover efficiency.

FAQs about inventory turnover ratio

What is the inventory turnover ratio?

It measures how many times your inventory is sold and replaced over a set period. This gives insight into how efficiently your business is managing its stock and converting it into revenue.

What does an inventory turnover ratio of 1.5 mean?

You’re turning over your inventory 1.5 times per year—which likely indicates slow movement or overstock. It suggests that your capital is tied up in stock that isn’t selling quickly enough.

Is a higher or lower inventory turnover ratio better?

Generally, higher is better, but not if it leads to frequent stockouts or unmet demand. A balanced ratio ensures you’re meeting customer demand without overstocking.

How to calculate inventory turnover?

Divide your cost of goods sold by your average inventory over the same period. This gives you a numeric value that reflects how many times you cycle through inventory in a given timeframe.