Managing costs and supply chain performance often comes down to one simple number: MOQ. Short for minimum order quantity, MOQ is one of the most important and misunderstood concepts in manufacturing, wholesale, and retail.

On the surface, MOQ looks simple: it’s the smallest number of units a supplier is willing to sell in one order. But in practice, it shapes everything from production schedules and cash flow to stock levels and customer service. Get it wrong, and you risk excess stock, waste, or missed sales. Get it right, and MOQ becomes a lever for efficiency and profitability.

This guide explains what MOQ is, why suppliers use it, how to calculate it, and how you can manage it effectively.

What is MOQ?

Simple definition of MOQ

MOQ stands for Minimum Order Quantity. It’s the threshold that suppliers set to ensure each order is worth their time, resources, and cost. If a supplier sets an MOQ of 500 units, you can’t place an order for 100. You’ll need to commit to at least 500 even if your immediate demand is lower.

MOQ explained with examples

- Textiles: A fabric mill may require buyers to order at least 1,000 metres to cover setup costs for weaving machines.

- Electronics: A headphone supplier might only sell to retailers in batches of 200, ensuring efficient packaging and shipping.

- Food & beverage: A bottled water producer may require a minimum of 5,000 bottles per order, because the production line needs to run at scale.

These examples highlight that MOQ is not arbitrary. It reflects a supplier’s cost structure, efficiency goals, and risk tolerance.

Why do suppliers use minimum order quantity?

MOQ isn’t just a preference. It’s a tool suppliers use to safeguard profitability and streamline operations.

Supplier production costs

Every production run involves fixed costs: labour, machinery setup, and raw materials. MOQ ensures suppliers cover these costs without losing money on small orders.

Risk reduction and efficiency

MOQ protects suppliers from tying up resources in small, fragmented orders. It also creates efficiency in shipping, packaging, and storage. In competitive markets, it helps suppliers standardise processes and manage demand consistently.

Better forecasting

Larger, more predictable orders make demand easier to forecast. Suppliers can plan production schedules, negotiate raw material purchases, and optimise capacity.

High vs. low MOQ

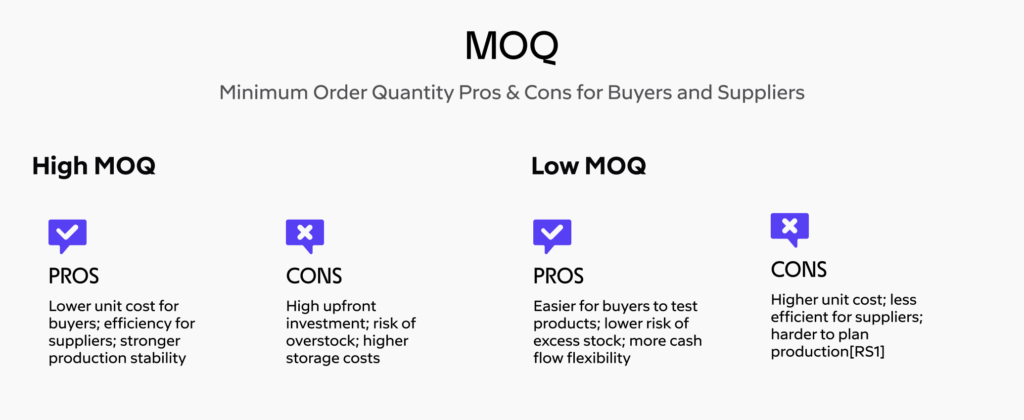

Understanding the difference between high and low MOQs helps businesses weigh up the trade-offs between efficiency, cost, and flexibility.

What does high MOQ mean?

A high MOQ forces buyers to purchase large quantities upfront. For example, a packaging supplier may set an MOQ of 10,000 boxes per order.

What does low MOQ mean?

A low MOQ allows buyers to order smaller batches. For example, a fashion wholesaler might allow boutique retailers to buy just 25 units per design.

Pros and cons for buyers and suppliers

Factors that influence MOQ

MOQ levels aren’t random. They’re shaped by a mix of operational realities, material costs, and strategic choices suppliers make. Understanding these factors can help buyers anticipate where a high or low MOQ is likely and prepare better strategies for negotiation.

Raw materials and sourcing

The cost and availability of raw materials are often the biggest drivers of MOQ. Suppliers dealing with scarce, seasonal, or expensive materials typically set higher MOQs to offset bulk-purchasing requirements. For example, a supplier of specialty metals may insist on large minimums because they must commit to buying entire lots from upstream providers.

On the other hand, suppliers with easier access to abundant or low-cost materials may offer more flexible MOQs. This is common in industries like apparel basics, where cotton and polyester are purchased in huge volumes globally and suppliers can spread costs across multiple buyers.

Order volume and scale

The scale of a supplier’s operations directly affects MOQ. Large-scale manufacturers usually rely on automation and batch production, which are only efficient when machines run continuously. To justify a production run, they set higher MOQs. For instance, a packaging manufacturer running high-speed printing machines may need to produce tens of thousands of units per batch to avoid idle capacity.

Smaller or boutique suppliers, however, often operate on smaller runs and can afford to keep MOQs lower. A craft food producer or niche cosmetics supplier might accommodate orders as small as a few dozen units, catering to buyers with limited budgets or test markets.

Supplier requirements

MOQ isn’t always about production — sometimes it’s about strategy. Some suppliers deliberately set higher MOQs as a way of filtering out small-scale or less profitable buyers, ensuring they only work with larger, established customers. This allows them to streamline operations and reduce administrative overhead.

However, suppliers may also adjust their MOQ based on relationships and trust. A long-term buyer who consistently pays on time and places repeat orders may be offered more favourable terms, including lower MOQs. Negotiation also plays a part: agreeing to a higher price per unit, longer lead times, or bundled orders can convince suppliers to lower their MOQ requirements.

Market conditions and demand

External market factors also influence MOQ. When demand is strong, suppliers may push MOQs higher to maximise production efficiency and prioritise larger customers. Conversely, during economic slowdowns or periods of weak demand, suppliers might lower their MOQs to attract more buyers and maintain steady cash flow.

MOQ vs. other order metrics

MOQ doesn’t exist in isolation. To make smart purchasing decisions, you need to consider how it interacts with other order metrics such as EOQ and ROQ. These metrics may sound similar, but each plays a distinct role in inventory planning.

MOQ vs. EOQ (Economic Order Quantity)

MOQ is supplier-driven. It reflects the minimum number of units a supplier is willing to sell to cover production costs and maintain efficiency. Whether or not that number aligns with your needs is secondary. If you want to work with that supplier, you have to meet their MOQ.

EOQ, on the other hand, is buyer-driven. It’s a calculation businesses use to determine the optimal number of units to order at one time. The goal of EOQ is to balance the costs of ordering (like administrative and shipping costs) with the costs of holding stock (like warehousing, insurance, and obsolescence).

In practice, EOQ often conflicts with MOQ. For example, your EOQ may suggest that ordering 300 units gives you the best balance between carrying costs and efficiency. But if your supplier sets an MOQ of 500 units, you face a decision:

- Do you increase your order to meet the MOQ, risking higher carrying costs?

- Or do you negotiate with the supplier, possibly paying a higher unit price for fewer units?

This trade-off highlights why understanding both MOQ and EOQ is essential. Businesses that ignore one in favour of the other risk either straining cash flow (by overstocking) or limiting supplier options (by refusing to meet MOQ).

MOQ vs. ROQ (Reorder Quantity)

While MOQ sets the threshold for starting an order, ROQ (Reorder Quantity) determines the timing of that order.

ROQ is the point at which your inventory levels fall low enough that you need to place a new order to avoid stockouts. For example, if you know it takes four weeks for a supplier to deliver, and you typically sell 100 units per week, your ROQ may be set at 400 units. Once stock hits that level, you trigger a new purchase order.

The challenge is that ROQ and MOQ can interact in ways that complicate planning. Imagine your ROQ is 400 units, but your supplier’s MOQ is 800. You can’t simply order 400 to match your needs, you’ll have to buy double and carry the extra stock until demand catches up.

This mismatch can affect both cash flow and warehouse space. Businesses that track both metrics carefully can better anticipate when conflicts will arise and either adjust ROQ, renegotiate MOQ, or refine their demand forecasts to smooth the balance.

Comparison of MOQ, EOQ, and ROQ

| Metric | Definition | Who controls it? | Main purpose | Risks if ignored |

| MOQ (Minimum Order Quantity) | The minimum number of units a supplier will sell in a single order | Supplier | Ensures suppliers cover production costs and operate efficiently | Buyers may overstock or strain cash flow if MOQ exceeds their demand |

| EOQ (Economic Order Quantity) | The optimal order size that minimises total inventory costs (ordering + holding) | Buyer | Balances cost of ordering with cost of carrying stock | Over-ordering or under-ordering leads to higher costs and inefficiency |

| ROQ (Reorder Quantity) | The stock level at which a new order should be placed to avoid stockouts | Buyer | Ensures timely replenishment and continuity of supply | Risk of stockouts if set too low; excess stock if demand changes unexpectedly |

How to calculate MOQ

Calculating MOQ involves more than picking a number. It’s based on production costs, demand patterns, and profitability targets.

A simple way to think about MOQ calculation is:

MOQ = Break-even point of production ÷ Average demand per order

Suppliers may include:

- Fixed costs per production run (e.g. machine setup, labour)

- Variable costs per unit (e.g. raw materials, packaging)

- Target profit margin

- Storage and shipping costs

MOQ calculation example

A supplier produces custom mugs.

- Setup cost: £500

- Variable cost per unit: £2

- Target profit margin: £1 per unit

- Average demand: 1,000 mugs

Break-even per order = £500 ÷ (£1 profit + £2 cost) = ~167 units.

The supplier may round this up and set MOQ at 200 to ensure coverage and profit.

In practice, MOQ varies widely by industry. Fast-moving consumer goods may have low MOQs, while industrial parts often have high MOQs due to production complexity.

How MOQ impacts supply chain and inventory management

The impact of MOQ goes far beyond a single order. It ripples through stock levels, cash flow, and customer satisfaction.

Effect on inventory costs

High MOQs can tie up working capital in storage, insurance, and handling. Businesses risk carrying costs if demand doesn’t match supply.

Effect on cash flow

Larger upfront orders demand significant capital. This can restrict flexibility and delay investment in other areas of the business.

Effect on customer satisfaction

MOQs can affect service levels. Too high, and you may overstock or discount to clear space. Too low, and suppliers may struggle to meet demand reliably.

How to manage MOQ

Managing MOQ effectively is about finding the balance between supplier requirements and your own business needs. It requires a mix of negotiation, data-driven planning, and the right tools to ensure you’re not overcommitting or underserving demand.

Negotiating with suppliers

MOQ isn’t always fixed. Buyers can:

- Accept higher unit costs in exchange for smaller orders.

- Offer long-term contracts to secure lower MOQs.

- Split orders across multiple buyers (group buying).

Using inventory management software

Technology makes MOQ easier to manage. Platforms can:

- Simulate different MOQ scenarios.

- Show the financial impact of bulk vs. small orders.

- Help coordinate purchasing across multiple suppliers.

Improving forecasting and turnover

Strong demand forecasting helps you align purchases with real demand. The better your data, the easier it is to balance MOQ with stock turnover.

Benefits of MOQ

MOQ isn’t only about restrictions. When managed well, it can create real value for both suppliers and buyers. By setting clear thresholds, suppliers gain stability and efficiency, while buyers can benefit from stronger partnerships, lower costs, and more predictable supply.

Benefits for suppliers

For suppliers, setting a minimum order quantity provides a safeguard against inefficiency and uncertainty, allowing them to focus on scaling production and maintaining healthy margins.

- More predictable revenue

- Improved production efficiency

- Reduced waste and risk of unsold goods

Benefits for buyers

For buyers, working within MOQ limits can unlock advantages beyond price, including improved relationships and stronger negotiating power over time.

- Lower per-unit costs when buying in bulk

- Stronger supplier partnerships

- Leverage in long-term negotiations

Key takeaways on MOQ meaning

MOQ defines the smallest amount a supplier will sell, but its impact runs through your entire supply chain. High or low, it influences costs, cash flow, forecasting, and customer service.

The good news: MOQ isn’t fixed in stone. With strong negotiation, better demand forecasting, and the right software, businesses can manage MOQ strategically — turning it from a cost burden into a driver of supply chain efficiency.

FAQ about MOQ

What does MOQ mean?

MOQ stands for Minimum Order Quantity, the smallest order size a supplier will accept.

Why do suppliers set MOQs?

To cover production costs, reduce risks, and maintain efficiency.

What is the difference between MOQ and EOQ?

MOQ is supplier-driven, EOQ is buyer-driven and focused on cost optimisation.

What does MOQ 50 mean?

It means you must purchase at least 50 units in a single order.

How does MOQ impact pricing?

Larger orders typically lower unit prices, while small orders may increase them.

How can a buyer reduce MOQ requirements?

By negotiating terms, accepting higher costs, or building long-term commitments.

Is a high MOQ always bad for business?

Not necessarily. For predictable, high-demand products, high MOQs can mean better margins and stronger supplier relationships.