ABC analysis helps you understand which items deserve tighter control and which can be handled with lighter oversight. It gives planners a structured way to rank products by importance and impact, which makes forecasting, prioritisation and safety stock decisions easier to manage. With demand patterns shifting more quickly than ever, high-level classification gives supply chain teams a reliable starting point for setting service targets and coordinating replenishment across complex assortments.

ABC analysis defined

ABC analysis groups items based on their contribution to overall performance. The traditional approach ranks products according to annual consumption value and then assigns them to A, B or C categories. Although the method is simple, it gives teams a strategic view of stock importance that supports day-to-day decision-making.

The ABC model explained: Categories A, B and C

A items contribute the largest share of financial impact. These products typically represent a small portion of the catalogue but drive most of the value. They often require closer monitoring because even a short disruption can affect service levels and revenue.

B items sit between high-impact and low-impact groups. They form a stable middle ground with dependable demand patterns and predictable contribution. These items deserve consistent attention, although they rarely need the same scrutiny as A items.

C items make up the largest share of SKUs but contribute the smallest proportion of value. Their role is essential, yet it rarely justifies high administrative effort. Bulk ordering, simpler rules and longer review cycles often give stronger results for these items.

Item examples within each category

- A items: high-margin components, best-selling products, items with strong customer loyalty.

- B items: mid-range goods with stable movement, moderate-value spare parts, regular seasonal items.

- C items: inexpensive consumables, long-tail articles, non-critical accessories.

These groups give planners a quick understanding of where service reliability has the greatest impact.

Single-factor vs two-factor ABC analysis

Many teams begin with single-factor ABC, where one metric defines the ranking. This is usually annual turnover or consumption value.

Supply chains have since grown more complex. A two-factor ABC approach blends two performance indicators, giving a more rounded view of item behaviour. For example:

- Turnover and sales line frequency reveal both value and customer reliance.

- Margin and cost price show which items protect profitability.

- Quantity sold and cost of goods sold highlight volume-driven impact.

Using two factors balances financial weight against behavioural importance. This produces a classification that reflects real-world performance rather than a single metric.

Handling new and dead items within ABC analysis

Some items cannot be classified meaningfully using historical patterns. New items have very limited sales history. Dead items have not sold for more than a year. Including either within the main analysis introduces noise and distorts category boundaries.

New items need cautious, balanced settings because early sales do not represent demand.

Dead items often require lower service levels or tailored handling because they are no longer active.

Treating both groups separately maintains high-quality classification and avoids inflated stock levels.

Grouping ABC analysis by location or segment

Demand differs across regions, business units and customer segments. A product may fall into the A group in one market but land in the C group elsewhere.

Location-based grouping captures regional behaviour and ensures policies align with real local demand.

Grouping by product hierarchy creates consistency within similar ranges.

Using both dimensions supports more relevant service-level settings.

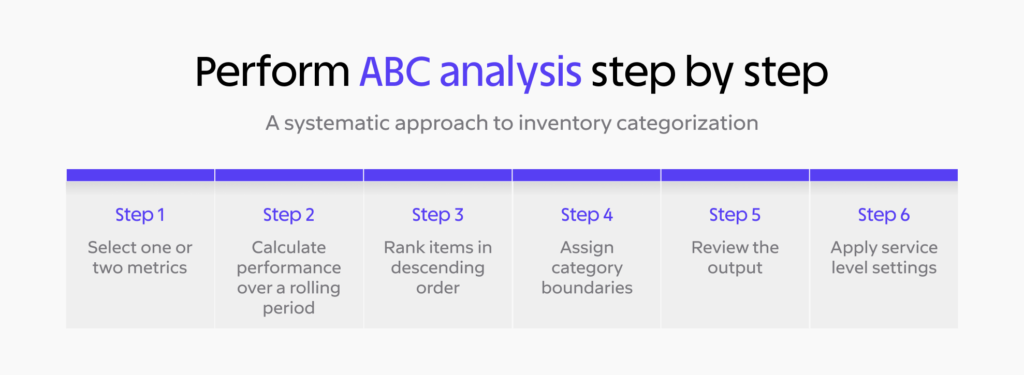

How to perform ABC analysis step by step

Step 1 – Select one or two metrics

Choose metrics that reflect what matters most, such as turnover, margin, cost of goods sold, quantity sold or sales line frequency.

For background on demand drivers, see our guide on demand forecasting.

Step 2 – Calculate performance over a rolling period

Analysing the last 12 months gives a full picture of demand and avoids seasonal distortion.

Step 3 – Rank items in descending order

Sort SKUs from highest impact to lowest impact.

Step 4 – Assign category boundaries

Typical splits include 70/20/10 or 80/15/5, but thresholds can be adapted to business structure.

Step 5 – Review the output

Sense-check the classification so it reflects operational knowledge. Items with long lead times or high criticality may need reclassification.

Step 6 – Apply service level settings

Once groups are set, the service-level expectations and safety stock can be aligned accordingly.

To understand the link between inventory methods, see FIFO meaning.

ABC analysis example

Consider a distributor with 3000 SKUs across several regions. After applying a two-factor ABC based on turnover and sales line frequency, the top segment becomes clear. High-value, high-frequency items rise into the A group because they shape both revenue and reliability. Mid-range products settle into the B group. Slow movers fall into the C group. This distribution helps the team prioritise forecasting, replenishment and safety stock settings with confidence.

Benefits and limitations of ABC analysis

The table below summarises ABC’s strengths and its natural constraints.

| Benefits | Limitations |

| ABC analysis gives clearer planning priorities so teams focus on the items that influence availability and financial performance the most. | ABC analysis simplifies complex demand behaviour, which means some products may be misclassified if used alone. |

| It improves safety stock allocation because high-importance items receive stronger service protection and lower tiers use leaner buffers. | Low-value items that are operationally critical may fall into a lower category unless a second metric is used. |

| It provides better visibility of how value and demand are distributed across the range, which strengthens purchasing and forecasting decisions. | ABC analysis depends on historical data, which may not reflect sudden market changes or emerging trends. |

| It creates more efficient review cycles by reducing the effort spent on slow movers while safeguarding high-impact items. | A single set of thresholds may not suit all locations or product groups, which is why segmentation improves accuracy. |

| It supports consistent replenishment policy because each category follows rules that match its risk and importance level. | New and dead items do not fit naturally into the model, so they require separate treatment to maintain reliability. |

Applying ABC analysis in inventory management

ABC analysis delivers the greatest value when linked to replenishment, forecasting and stock control.

How ABC supports stock control

A items use tighter rules because availability matters more.

B items follow balanced settings.

C items benefit from lean stock and efficient replenishment.

For deeper context on replenishment, read what stock replenishment is.

Using ABC to improve forecasting and safety stock

The method ensures forecasting models focus on items with the highest operational and financial impact.

To see how forecasting contributes to performance, explore inventory turnoverratio.

Combining ABC with other inventory concepts

ABC pairs well with methods explained in other AGR resources such as inventory management fundamentals and MOQ.

ABC analysis in AGR

ABC analysis becomes more powerful when supported by structured configuration. AGR brings together several features that strengthen classification and service-level decisions.

You can choose one or two ABC metrics such as turnover, margin, cost of goods sold, quantity sold, sales line frequency or cost price. Selecting two creates a richer picture of item importance and better reflects financial contribution and demand behaviour.

Items can be grouped by location or product hierarchy, allowing category boundaries to reflect the realities of different markets and assortments. This helps avoid the limitations of using a single classification across an entire network.

New and dead items do not enter the main analysis. New items receive careful handling because early sales do not reflect ongoing demand. Dead items, which have not sold in twelve months, follow their own settings to prevent unnecessary stock.

Confidence factors create the link between importance and service level. Each ABC combination receives a unique confidence value. Higher values result in stronger service protection. Lower values maintain leaner stock. This tiered structure aligns availability expectations with real business impact.

Annualised ABC can scale the demand of early-life items to a twelve-month view. This gives planners a more realistic starting point without waiting for a full sales cycle.

Once configuration is complete, classifications can run immediately or overnight. Updates appear directly in items, stock and reporting. This ensures ABC analysis remains current and aligned with live demand.

FAQ about ABC analysis

What is the difference between the ABC model and the ABC method?

The model defines the A, B and C groups. The method refers to the calculation, ranking and assignment process.

How often should ABC analysis be updated?

Many businesses update the classification monthly or quarterly. Higher-variability environments benefit from more frequent updates.

Is ABC analysis useful outside inventory management?

Yes. ABC classification also supports purchasing, warehouse layout, cycle counting and product lifecycle decisions.

Why use more than one ABC metric?

Using two metrics gives a more accurate and balanced view of item importance by combining value, frequency and behavioural considerations.

What happens to new or inactive items?

New and dead items sit outside the main categories because their demand patterns are not stable enough for classification.