Cost of sales is one of the most important numbers on your profit and loss statement. It shows how much it costs to produce or purchase the goods you sell and it directly shapes margins, pricing decisions and long term profitability. Cost of sales is the total direct cost required to produce or purchase the goods and services a company sells.

In this guide, you will learn what cost of sales means, how to calculate it, how it differs from cost of goods sold and how stronger planning can help you keep costs under control.

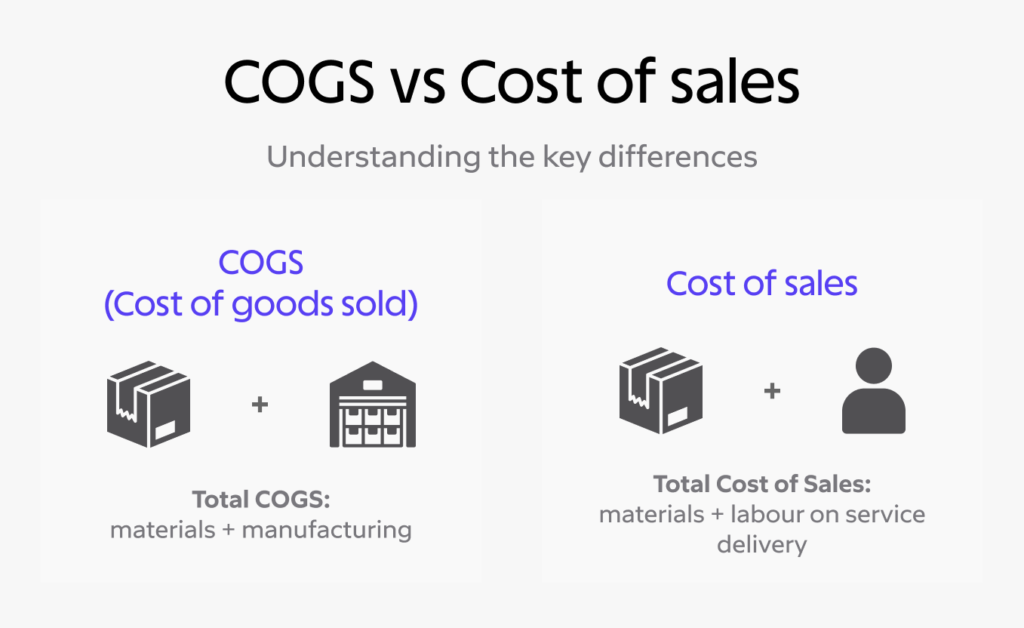

Cost of sales vs cost of goods sold

Cost of sales and cost of goods sold (COGS) are closely linked, but not identical. COGS is an accounting term used widely in manufacturing and retail. It includes all direct costs tied to producing or purchasing goods. These typically include raw materials, direct labour and inbound freight.

For a deeper accounting explanation of COGS, see the Investopedia breakdown.

Cost of sales is a broader term used across industries, especially when businesses deliver both goods and services. It includes the direct costs required to deliver a product or service to a customer. It does not include overhead costs such as marketing, rent, admin or software.

Both cost of sales and COGS focus strictly on direct inputs. They show the real cost behind every pound of revenue and form the basis of the gross profit calculation.

Why cost of sales is important

Cost of sales influences far more than the finance team. It reflects how your entire supply chain performs, from forecasting and purchasing through to inventory control and operations.

Understanding profitability

Gross profit depends on the relationship between revenue and cost of sales. Even strong sales performance cannot compensate for a rising cost base. Tracking cost of sales helps you understand whether your pricing, supplier terms or replenishment decisions are contributing to healthy margins or eroding them.

Identifying inefficiencies

If cost of sales increases without a clear cause, it is often a sign of operational inefficiencies. You might be purchasing too frequently, buying in the wrong quantities or carrying stock that is not aligned with customer demand. These weaknesses become clearer when you monitor the right metrics. AGR’s full guide to inventory KPIs outlines how to evaluate your supply chain performance.

The link between cost of sales and inventory management

Inventory has a direct impact on cost of sales. Poor visibility leads to unnecessary purchases, emergency shipments and excess stock. Slow movers increase holding costs and the risk of write offs. Optimised planning reduces waste, improves decision making and keeps cost of sales within a stable range.

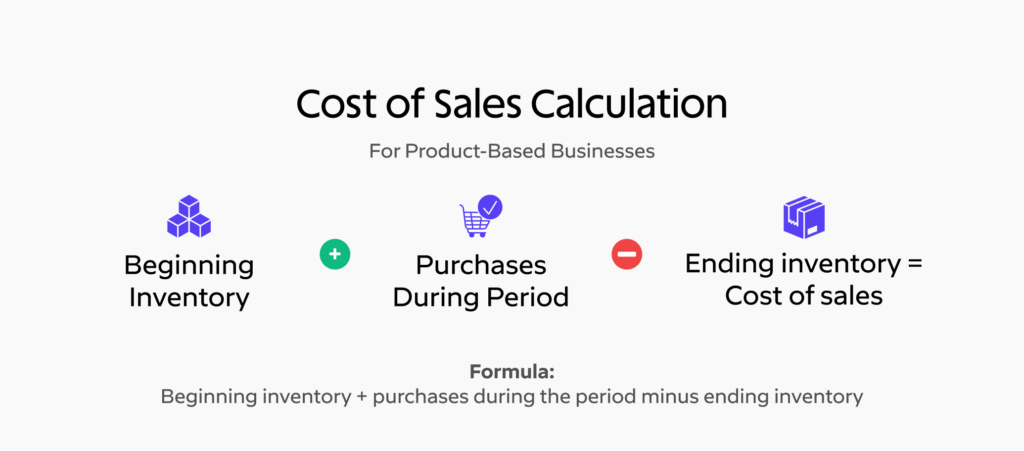

How to calculate cost of sales

For product-based businesses, the standard formula for cost of sales is:

Beginning inventory + purchases during the period minus ending inventory

This shows the value of stock that has moved out of the business to support revenue.

Adjustments for returns and discounts

To produce a reliable picture, you should adjust for:

- Customer returns

- Trade discounts

- Supplier rebates

- Credit notes

- Damaged, expired or written off items

These adjustments help ensure your cost base is neither overstated nor understated.

Cost of sales formulas for different business types

Although the underlying logic stays the same, the calculation and cost drivers vary by industry. Below are detailed formulas and real examples to show how each business type arrives at its cost of sales figure.

Service businesses

Service businesses rely heavily on people, so direct labour is a major part of cost of sales. Subcontractor support and consumables also fall within the calculation.

Formula:

Direct labour + subcontractor costs + consumables

Example:

A commercial cleaning business sends three technicians to a warehouse client.

- Technician wages: £360

- Cleaning chemicals and supplies: £40

- Specialist subcontractor fee: £120

Cost of sales: £360 + £40 + £120 = £520

This total excludes overheads such as office rent or admin salaries because they are not directly tied to the service delivered.

Retailers and wholesalers

Retailers and wholesalers have a simpler structure because they purchase finished goods rather than produce them.

Formula:

Opening stock + purchases during the period minus closing stock

Example 1: Industrial cleaning supplies wholesaler

- Opening stock: £80,000

- Purchases: £60,000

- Closing stock: £90,000

Cost of sales: £80,000 + £60,000 − £90,000 = £50,000

This means £50,000 worth of stock left the warehouse during the month.

Example 2: Electronics component distributor

- Opening stock: £300,000

- Purchases: £500,000

- Closing stock: £650,000

Cost of sales: £300,000 + £500,000 − £650,000 = £150,000

Although the business purchased heavily, most stock remained unsold, which may suggest slower sales or a shift in demand. Pairing this with the inventory turnover ratio helps confirm whether stock is moving at the right pace. AGR explains turnover formulas and examples in detail.

Manufacturers

Manufacturers face the most complex cost of sales calculation because they convert raw materials into finished goods.

Formula:

Direct materials + direct labour + manufacturing overhead minus ending finished goods

Many manufacturers also account for work in progress (WIP).

Example 1: Furniture manufacturer

- Direct materials: £42,000

- Direct labour: £18,000

- Manufacturing overhead: £12,000

- Ending finished goods: £8,000

Cost of sales: £42,000 + £18,000 + £12,000 − £8,000 = £64,000

This represents the cost of completed goods that were actually sold.

Example 2: Cosmetics manufacturer with WIP

- Direct materials: £90,000

- Direct labour: £40,000

- Manufacturing overhead: £25,000

- Ending finished goods: £20,000

- Ending WIP: £15,000

Adjusted cost of sales:

£90,000 + £40,000 + £25,000 − £20,000 − £15,000 = £120,000

Subtracting WIP ensures costs only apply to completed units.

Hybrid businesses

Some businesses deliver both goods and services. Their cost structure blends inventory and labour.

Formula:

Cost of goods sold + direct service labour + project specific materials

Example: Lighting distributor providing installation

- Cost of goods sold (fixtures): £25,000

- Electrician labour: £3,200

- Installation accessories: £600

Cost of sales: £25,000 + £3,200 + £600 = £28,800

This approach captures the full cost of delivering the final solution to the customer.

Why choosing the right formula matters

Your cost of sales calculation must match your operating model. When it does, you benefit from:

- accurate product or category level profitability

- more reliable pricing and discount decisions

- better visibility of waste and inefficiencies

- a stronger link between supply chain data and financial reporting

- clearer conversations between finance, purchasing and operations

It also ensures your gross margin percentages are meaningful and comparable across seasons and product lines.

How to reduce cost of sales

Reducing cost of sales is not about cutting quality or pressuring suppliers. It is about improving efficiency and planning. The following strategies help businesses protect margins while improving operational performance.

Improve demand forecasting

Poor forecasting is one of the most common causes of rising cost of sales. It leads to overbuying, emergency purchases, excess stock and wasted capital. AGR’s data driven forecasting enables more accurate planning so you buy what you need and avoid unnecessary costs.

Automate replenishment

Manual ordering increases the risk of errors and late decisions. Automated replenishment ensures orders are placed at the right time and at the right quantity based on real demand. This reduces expedited freight and eliminates reactive ordering costs.

Gain visibility across the supply chain

Stockouts, overstocking, long lead times and slow movers are expensive. With full visibility into stock levels across locations, supplier reliability and item performance, you reduce waste and maintain a healthier cost base.

Frequently asked questions about cost of sales

What is the difference between cost of sales and operating expenses?

Cost of sales includes only direct costs tied to producing or purchasing goods. Operating expenses include indirect costs such as rent, admin, marketing and overhead.

Can cost of sales change each month?

Yes. Cost of sales fluctuates with purchasing patterns, supplier price changes, seasonal demand and inventory levels.

Where can I find cost of sales on financial statements?

Cost of sales appears beneath revenue on the profit and loss statement. It is used to calculate gross profit.

How does inventory management affect cost of sales?

Inventory and cost of sales are closely linked. Excess stock, emergency orders, long lead times and inaccurate data all increase your cost base. Strong forecasting and replenishment keep costs predictable and controlled.

Optimise your cost of sales with AGR Inventory

Cost of sales reflects the health of your supply chain. When planning is accurate, replenishment is automated and data is reliable, your cost base becomes predictable and margins improve.

AGR helps businesses reduce cost of sales by improving forecast accuracy, automating purchasing decisions and providing deep visibility across stock, suppliers and item performance. With the right tools and data, you can reduce waste, protect working capital and make confident decisions that support growth.

If you would like to see how AGR can help you strengthen your margins, our team is ready to guide you through it.